We develop financial models that serve as tools for making strategic decisions such as: mergers and acquisitions transactions, capital or debt restructurings and determination of shareholder value.

Business Valuation

WE DEVELOP FINANCIAL MODELS THAT INCLUDE  Business Portfolio Analysis

Business Portfolio Analysis

The key to achieve sustainable growth is to reinvest in new businesses that yield a return above the cost of capital. By reinvesting in a strong competitive position, a company can become self-sufficient; we help companies reach that point by analyzing the following:

A complete diagnosis of the Company’s Operations

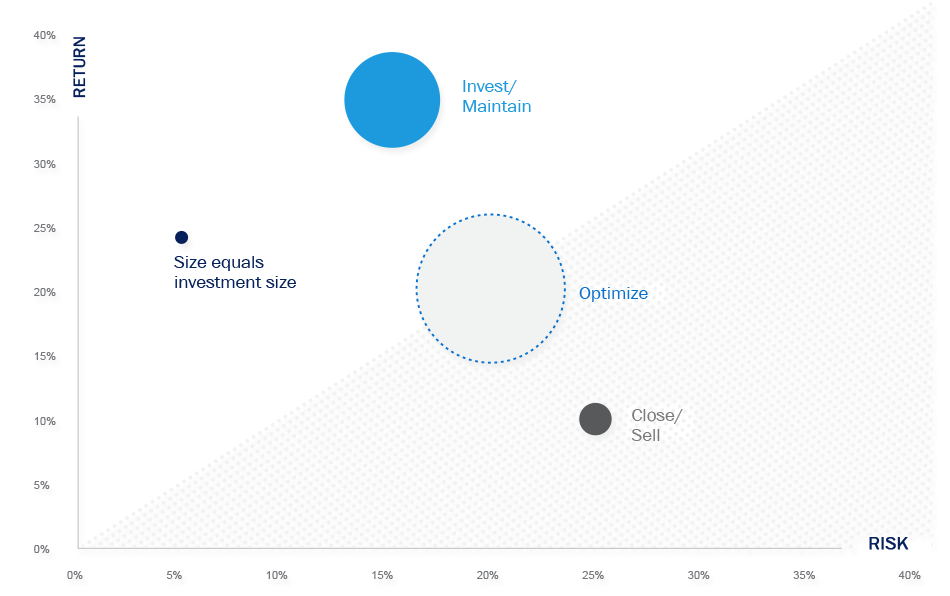

- We perform an analysis of the value generation potential of each business by examining current and expected returns and compare it to the intrinsic risk of each business (ROIC vs WACC, discounted cash flows, margin analysis, growth/expansion potential)

- We examine the strategic fit of each business within a group by asking: which business would we like to be a part of? Which businesses would we like to get out of?

- We look for potential synergies within a group of companies or within the business units of a company.

Capital allocation among businesses and investments

- Based on the diagnosis, we advise our clients through the analysis and decision making process of how to allocate their resources among their businesses and investments, including: